Construction Budgeting: The Ultimate Guide (2024)

-

Sapna

- April 18, 2024

Construction budgeting is a strategic process that involves estimating the total costs of a construction project to ensure financial resources are used efficiently. This critical aspect of project management can have a groundbreaking impact on a project’s success, influencing everything from timely completion to overall project quality. So, understanding and having in-depth knowledge of the construction budget is essential in a construction business.

In this blog, we’ll explore how effective construction budgeting can be key to delivering projects successfully and what factors we need to consider and avoid while planning the construction budget. So dive in and learn the role of construction budgeting in the construction industry.

Table of Contents

ToggleWhat Is a Construction Budget?

A construction budget is a detailed financial plan that estimates the total costs associated with building or infrastructure construction. This budget includes direct costs such as materials, labour, and equipment and indirect costs like administrative expenses, insurance, and permits. It also typically incorporates contingency funds for unexpected expenses during the project. The construction budget is essential for managing resources, controlling costs, and ensuring a project’s profitability and timely completion.

Why Is Construction Budgeting Important?

A construction budget is important in managing resources, controlling costs, facilitating stakeholder communication, and ensuring project profitability. Without a well-planned budget, there is a higher risk of cost overruns, project delays, and financial losses.

Construction budgeting is critically important for several reasons such as:

- Cost Control: Construction budgeting helps manage and control a construction project’s expenses, ensuring that costs do not exceed the allocated budget. Effective budgeting can prevent financial overruns and help identify potential savings.

- Risk Management: Maintaining a detailed budget will allow project managers to foresee financial risks and make provisions for unforeseen costs through contingency funds. This proactive approach can mitigate risks associated with cost overruns and project delays.

- Resource Allocation: By defining how resources will be spent, construction budgeting ensures that funds are allocated efficiently across different project segments, from materials and labour to equipment and other necessary services.

- Decision Making: A well-planned budget acts as a financial blueprint for the project, guiding decision-making processes at every stage. It helps determine the feasibility of project goals and the strategic allocation of financial resources.

- Stakeholder Communication: Budgeting facilitates clear communication among all stakeholders, including investors, contractors, and project managers. It provides a transparent framework for discussing financial expectations and progress.

- Project Profitability: Ultimately, effective budgeting is key to ensuring the profitability of a construction project. By keeping costs within budget and managing resources effectively, the project is more likely to be financially successful.

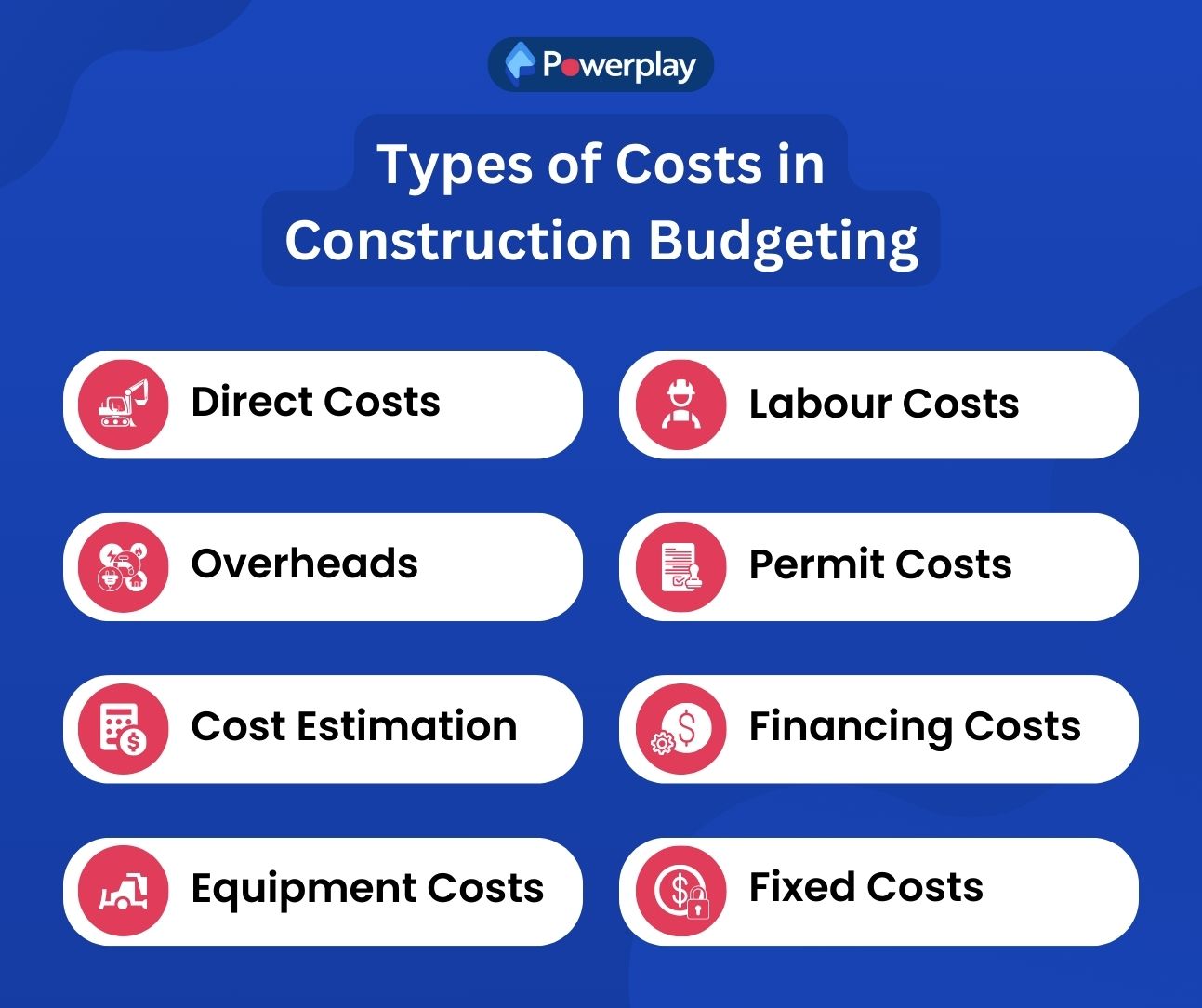

Types of Costs in Construction Budgeting

Construction budgeting is categorised into several types, such as:

Direct Costs are expenses directly tied to physical construction, such as labour and materials. They typically comprise the largest portion of a construction budget.

Labour Costs: It includes wages paid to workers and subcontractors. Labour costs can vary greatly depending on the skill level required, the complexity of the project, and regional wage rates.

Overheads: Overhead costs cover the operational expenses of running a construction business, such as office rent, utilities, and administrative salaries. These costs are not directly tied to a specific project but are necessary for business operations.

Permit Costs: These are fees paid to local or governmental authorities for legal permission to start construction. Permit costs vary by location and the scope of the project.

Cost Estimation: This involves predicting the financial resources needed for a project. Accurate cost estimation helps in budgeting and financial planning, reducing the risk of overspending.

Financing Costs: These costs arise from the interest on loans taken out to fund the project. Financing costs depend on loan terms and interest rates.

Equipment Costs: Expenses related to the leasing or purchasing of construction equipment. It also includes maintenance and operational cost.

Fixed Costs: Fixed costs are expenses that do not change irrespective of the project size or duration, such as insurance premiums and some leased equipment. Fixed costs are predictable and easier to budget as they remain constant over time.

What Costs do you need to Track to make an Effective Construction Budget?

It is very important to create an adequate construction budget to ensure the project is planned and completed successfully within budget, so it’s essential to track a variety of costs that significantly impact overall project financing, such as

- Direct costs like materials and labour form the bulk of construction expenses.

- Indirect costs such as administrative salaries, supervisory wages, and office operational costs must also be monitored.

- Overhead expenses, which cover general business operations and specific project costs like equipment rental, design fees, and permit costs, are crucial.

- Additionally, costs involved in accounting for financing costs from loans, contingency funds for unforeseen expenses, and insurance premiums ensure a comprehensive budget.

Properly tracking all these costs will help construction owners and other stakeholders clearly understand their spending, allowing them to maintain financial control and avoid cost overruns.

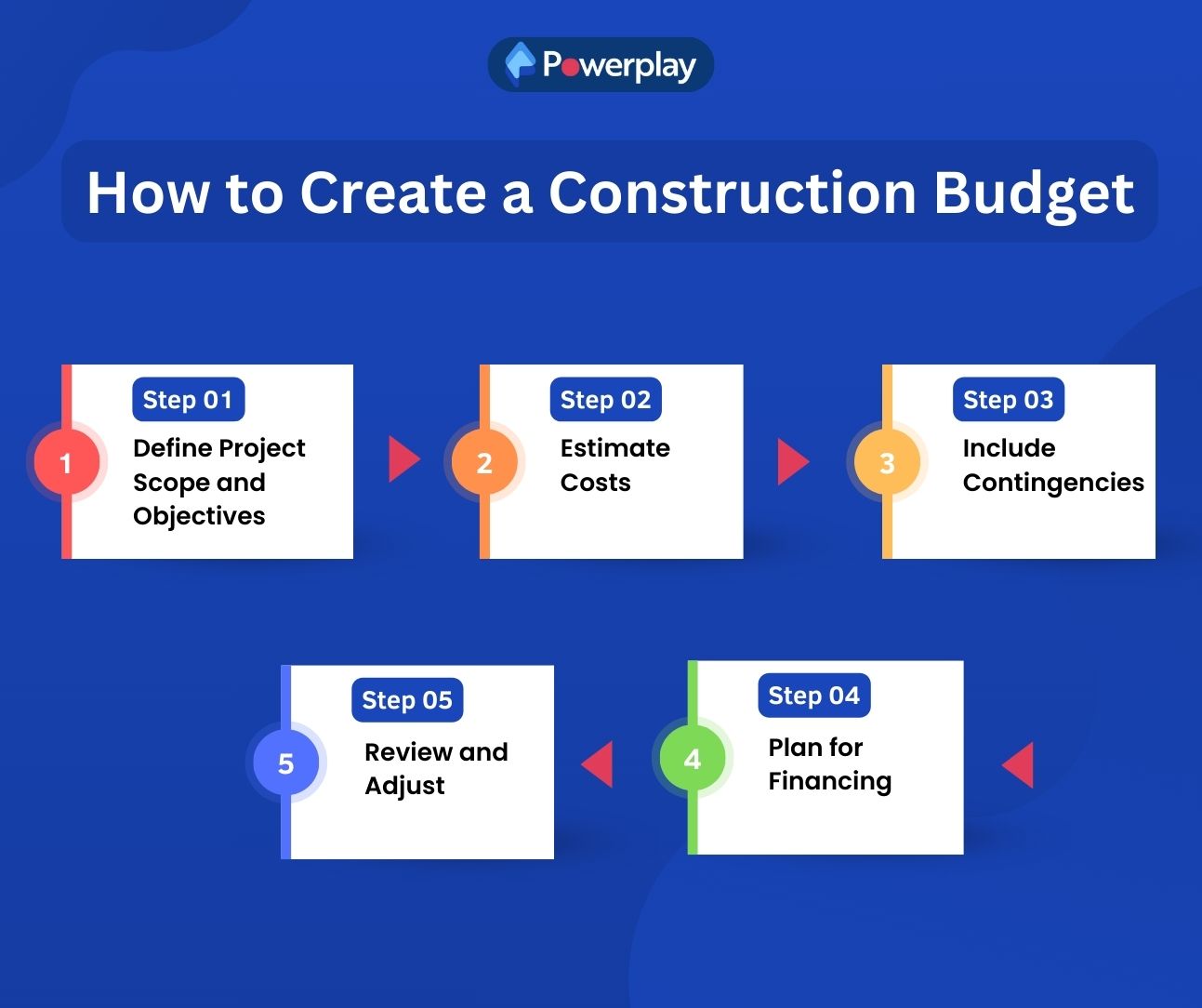

How to Create a Construction Budget

Creating a construction budget involves careful planning and attention to detail to ensure financial feasibility and successful project completion. Here’s a step-by-step guide to creating a construction budget.

Step 1: Define Project Scope and Objectives: Before anything else, clearly define the construction project’s scope, goals, and desired outcomes. This includes identifying all project requirements and expectations that will influence the budgeting.

Step 2: Estimate Costs: Gather detailed estimates for all potential expenses. This should include direct costs like materials and labour, as well as indirect costs such as administrative expenses, permits, and equipment rental. Use historical data, vendor quotes, and industry standards to inform your estimates.

Step 3: Include Contingencies: It’s important to prepare for unexpected costs by including a contingency allowance in your budget. Typically, this is around 5-10% of the total estimated costs, depending on the project’s complexity and risk.

Step 4: Plan for Financing: Determine how the project will be funded. Will it require financing through loans, or will it be funded out of pocket? Include any interest or finance charges in your budget planning to ensure a comprehensive financial overview.

Step 5: Review and Adjust: Once the initial draft of the budget is prepared, review it with all key stakeholders to ensure it meets the project’s needs and is realistic. Adjust as necessary based on feedback and additional insights. As the project progresses, continuously monitor expenses and compare them with the budgeted amounts, adjusting the budget as needed to reflect actual costs.

Things to Avoid When Construction Budgeting

When managing construction budgets, avoiding certain pitfalls is important to ensure financial stability and project success. Here are five key things to avoid:

Underestimating Costs:

One of the most common mistakes in construction budgeting is underestimating the costs associated with materials, labour, equipment, and unexpected contingencies. This can lead to significant financial shortfalls as the project progresses.

Poor Risk Management:

Failing to account for potential risks and not having a contingency plan can be detrimental. It’s vital to identify possible risks early in the project planning phase and allocate funds accordingly to manage these risks without derailing the budget.

Inadequate Tracking:

Not continuously monitoring and tracking expenses against the budget can lead to overspending without realisation until it’s too late. Effective budget management requires regular review and adjustments based on actual spending and project progress.

Neglecting Change Orders:

Ignoring the financial implications of change orders can disrupt the entire budget. It’s essential to evaluate and approve change orders carefully, understanding their impact on the total project cost and timeline.

Over-Reliance on Initial Estimates:

Relying too heavily on initial estimates without considering market volatility or updates based on project specifics can lead to unrealistic budgeting. It’s crucial to update the budget as new information becomes available and as project details are refined.

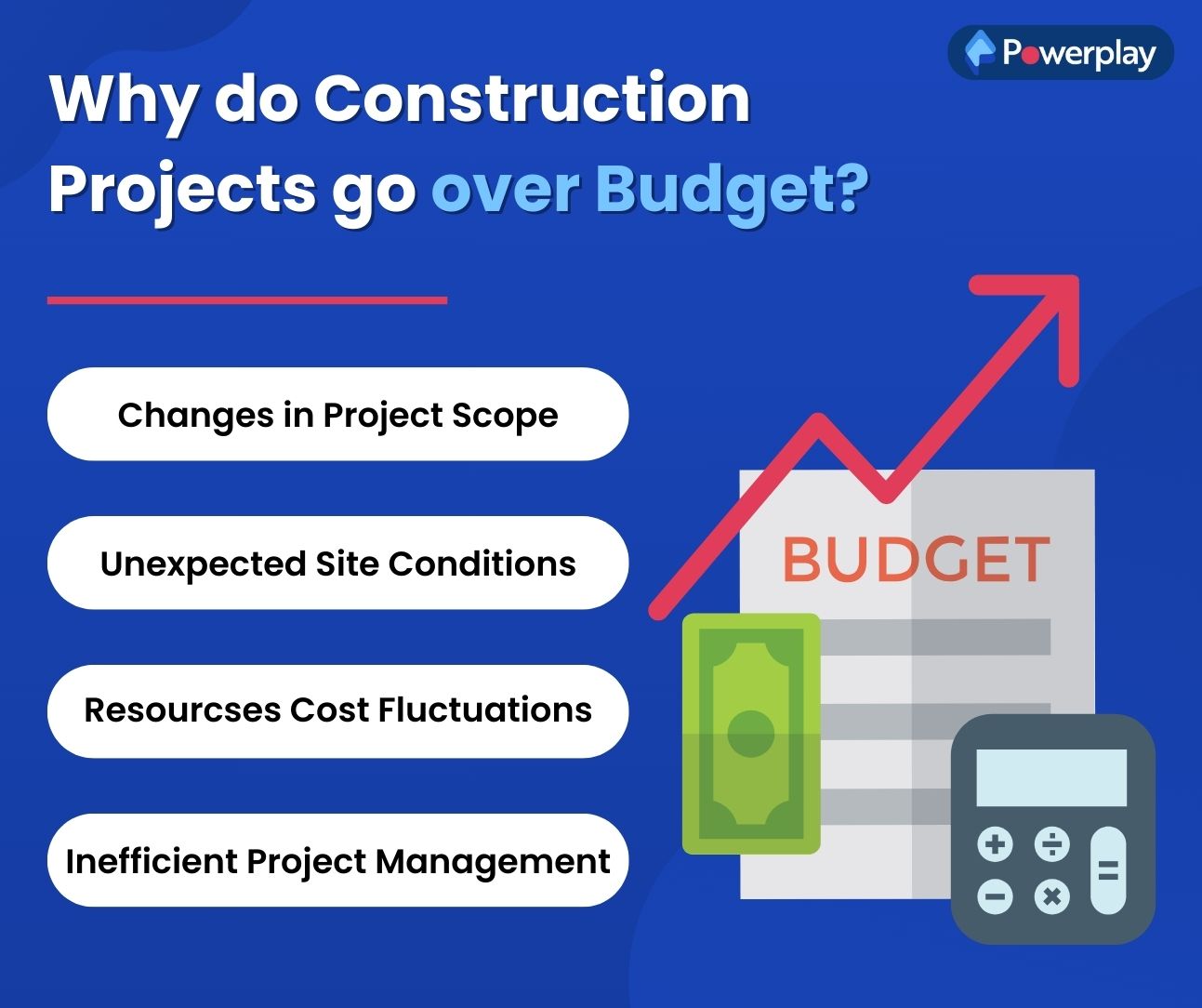

How often do Construction Projects go over Budget?

Budget management in construction is a significant challenge. Due to the nature of construction projects, various variables, and unforeseen circumstances, many companies have faced cost overruns issues. According to a survey, about 75% of construction project owners reported that their projects went over budget, which has been a high frequency and underscores the difficulties in maintaining financial control within the sector.

Why do Construction Projects go over Budget?

The incidence of budget overruns in construction projects can be attributed to several common factors, such as:

- Changes in Project Scope: Scope creep, where the project’s initial parameters are expanded or changed, often leads to increased costs that were not accounted for in the original budget.

- Unexpected Site Conditions: Encountering unforeseen issues like subsurface problems, environmental restrictions, or other complications can significantly increase costs.

- Material and Labor Cost Fluctuations: Prices for materials and labour can vary significantly, especially in volatile economic conditions, leading to budget overruns.

- Inefficient Project Management: Lack of proper planning, coordination, and control can lead to inefficiencies and wastage, pushing project costs higher than initially planned.

Factors Influencing Construction Budgets

Factors influencing construction budgets are crucial for project managers and stakeholders to consider for successful financial management. Understanding these factors helps in preparing more accurate budgets and anticipating potential changes that may affect project costs.

Here are five factors that can significantly impact construction budgets:

Market Conditions

Economic trends can significantly affect construction budgets. For instance, inflation can increase the cost of materials and labour, while economic downturns might lead to decreased costs due to lower demand.

Construction Site Location

The location of a construction site influences costs due to varying prices of materials, labour availability, transportation expenses, and local regulatory requirements, all of which can impact the overall budget.

Supply and Demand

The basic economic principle of supply and demand is critical in construction budgeting. A limited supply of materials or labour can drive up costs, while high availability might reduce them.

Weather Conditions

Weather impacts construction schedules and safety. Adverse weather can cause delays, necessitating extended equipment rental and labor retention, increasing costs.

Labour Rates

Labour costs are affected by the regional availability of skilled workers, prevailing wage laws, and unionisation. Higher labour rates increase project costs, particularly in regions with shortages or high demand for skilled workers.

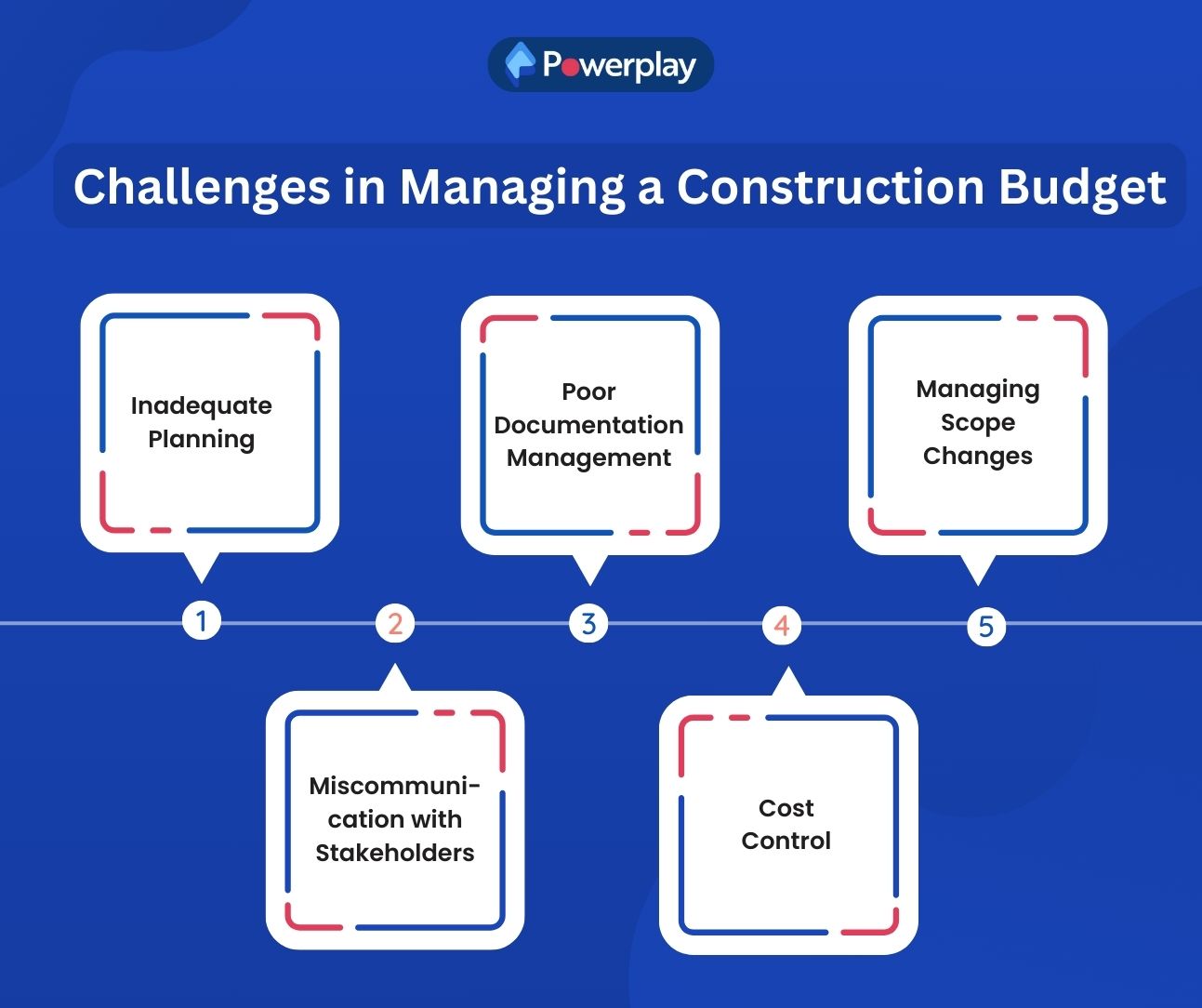

Challenges in Establishing and Managing a Construction Budget

Establishing and managing a construction budget involves various challenges that can affect the success and efficiency of a project. Let’s explore five common challenges which are faced by owners and other stakeholders:

Inadequate Planning

Proper planning is crucial for a project to be completed on time and within budget. Insufficient planning can lead to inaccurate capacity planning and unidentified task interdependencies, which may cause budget overruns and project delays.

Miscommunication with Stakeholders

Effective communication with all stakeholders, including staff, subcontractors, and clients, is essential. Miscommunications can lead to misunderstandings and costly errors impacting the budget.

Poor Documentation Management

Adequate documentation is vital for tracking progress and managing the budget effectively. Poor documentation practices can lead to resource mismanagement and budget discrepancies.

Cost Control

Managing and controlling costs throughout the project lifecycle is challenging but essential to preventing overruns. It involves detailed monitoring and adjusting budget allocations according to project needs.

Managing Scope Changes

Scope changes are common in construction projects and can significantly impact the budget. Managing these changes without letting them derail the budget requires flexible and responsive budgeting practices.

How Powerplay helps with Construction Budgets?

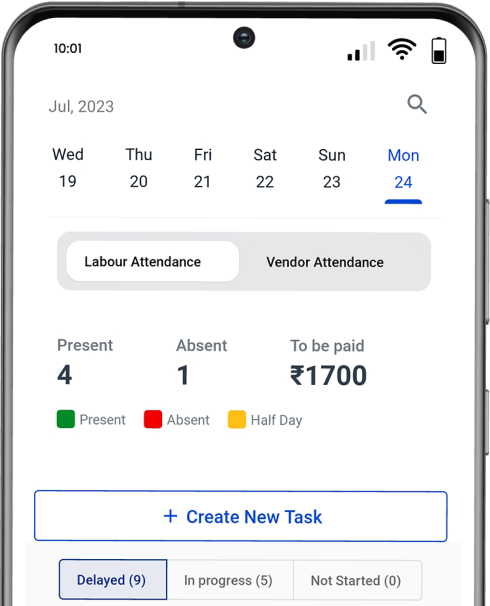

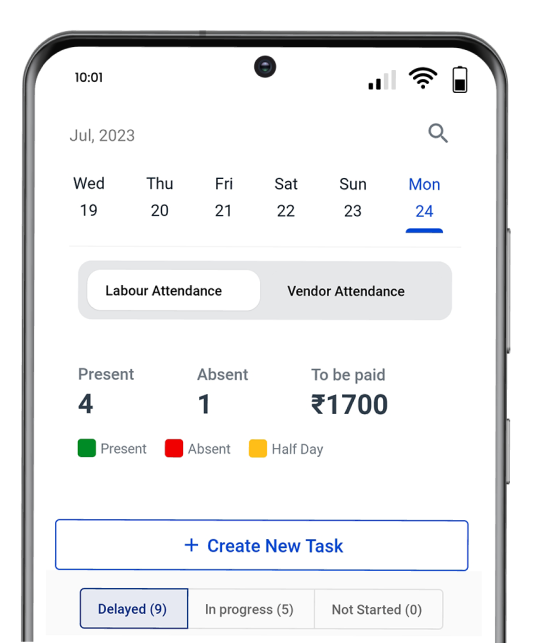

Powerplay is India’s most trusted construction management software. It is designed to streamline various aspects of construction projects, including budgeting, scheduling, and resource management. It offers various user-friendly features integrating these functions to enhance project efficiency and control.

Key features:

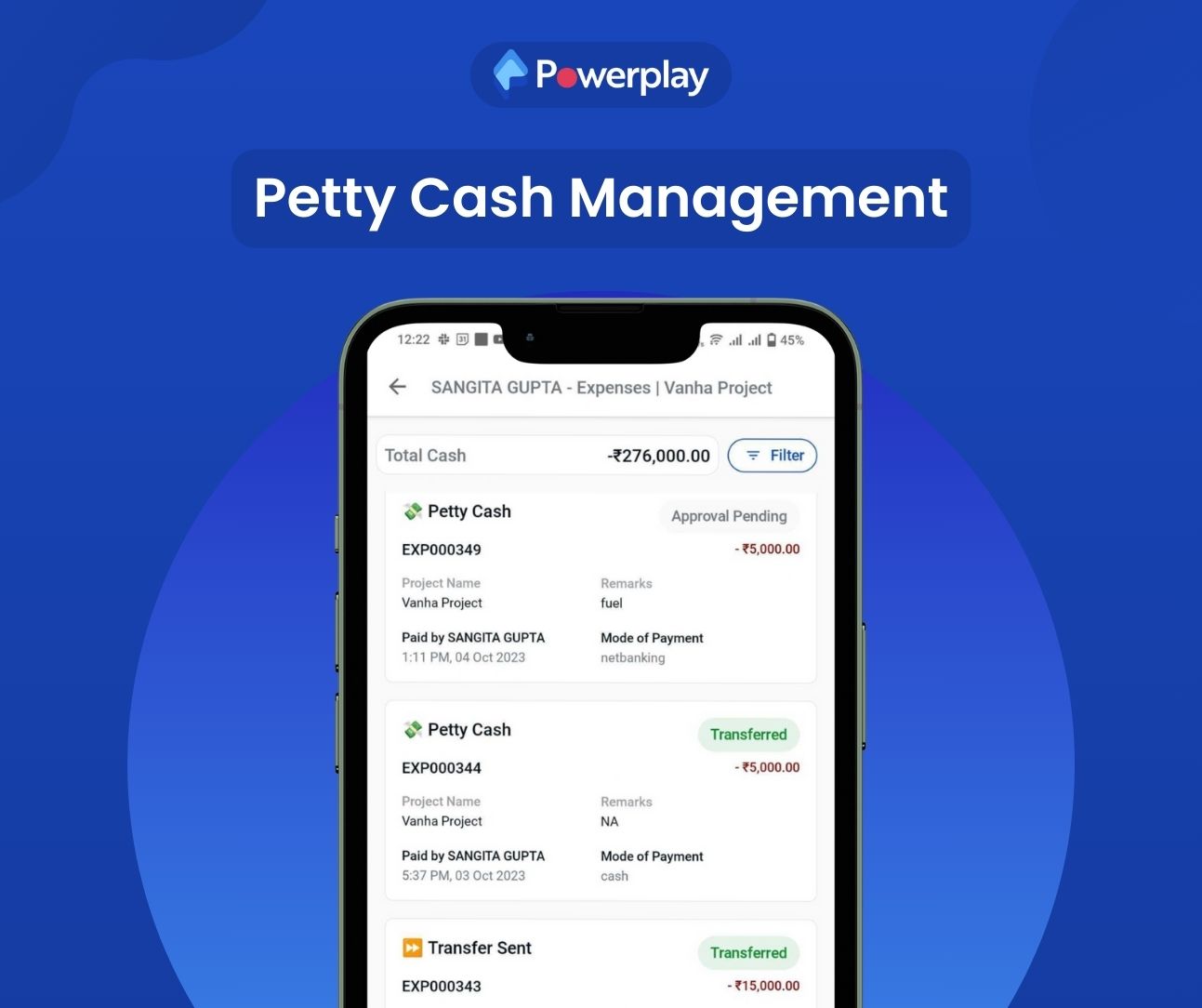

Petty Cash Management: This feature helps manage the small, day-to-day expenditures that occur on a construction site. Powerplay’s petty cash management tool allows tracking these minor expenses in real time, ensuring they are documented and accounted for correctly. This helps maintain accurate financial records and prevent budget discrepancies.

Labour Payments: Effectively managing labour costs is critical in construction. Powerplay’s labour payment feature simplifies racking and disbursing payments to workers, ensuring that all labour expenses are recorded accurately and workers are paid on time, thus avoiding disputes and maintaining morale.

Material Invoice Reports: This feature enables the tracking of materials purchased and used in the construction process. By generating detailed material invoice reports, Powerplay helps project managers monitor material costs, compare them with budget allocations, and adjust procurement strategies as necessary. This ensures that spending on materials remains within budget and is aligned with project needs.

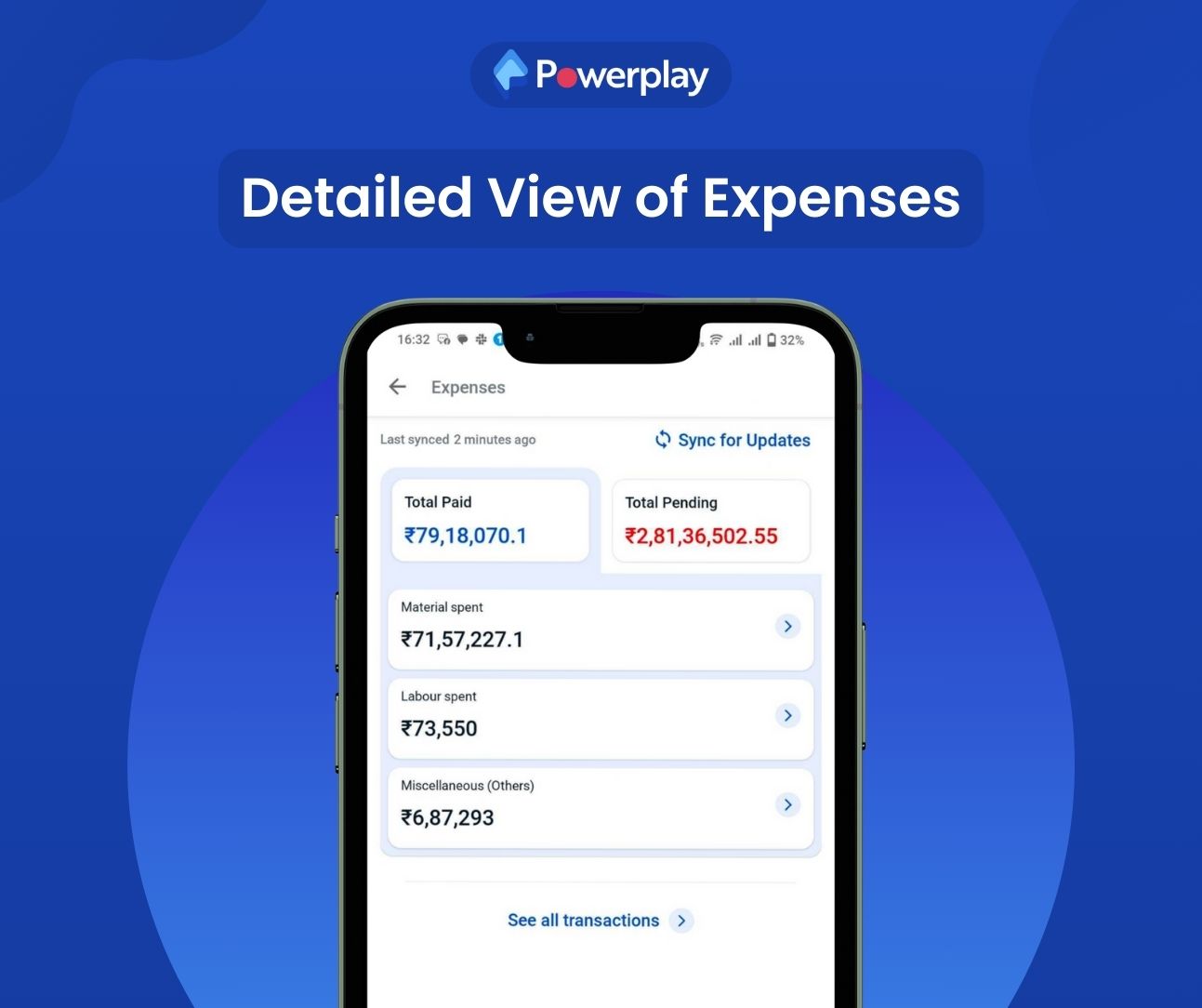

Detailed View of Expenses: Powerplay provides a comprehensive view of all project-related expenses in one dashboard. This detailed breakdown includes costs from different categories, such as labour, materials, equipment, and other overheads. A detailed view helps identify any financial outliers or unexpected costs early, allowing for timely corrective actions.

Conclusion

Effective construction budgeting is crucial for successful project delivery, ensuring projects are completed on time and within financial constraints. In this digitalised world, approximately 70% of companies that have adopted construction management software for budgeting have reported greater success in achieving their projects within budget.

Powerplay, a construction management software, is one of the best ways to manage your construction budget effectively and prevent your projects from going over budget. Request a free demo now.